Colorado

Blue Water Credit – Colorado

Your Best Colorado Credit Repair Specialist. Blue Water Credit is the Colorado leader in credit repair!

Whether your credit only needs a quick fix, or a total rebuild, we can help you. Once your destination has been defined, we will develop a unique strategy to repair your past, restore your present, and rebuild your future.

Risk Free Credit Consultation

Free Credit Consultation

Blue Water Credit is the best option for fixing your credit and repairing your score in Colorado!

Dozens of credit repair companies can be found in Colorado. They advertise that they are in a position to provide support and assistance to the people who have requirements with related to boosting the credit. However, not all those companies are capable of delivering the best service. That’s why people who live in Colorado often get confused with finding the ideal service provider.

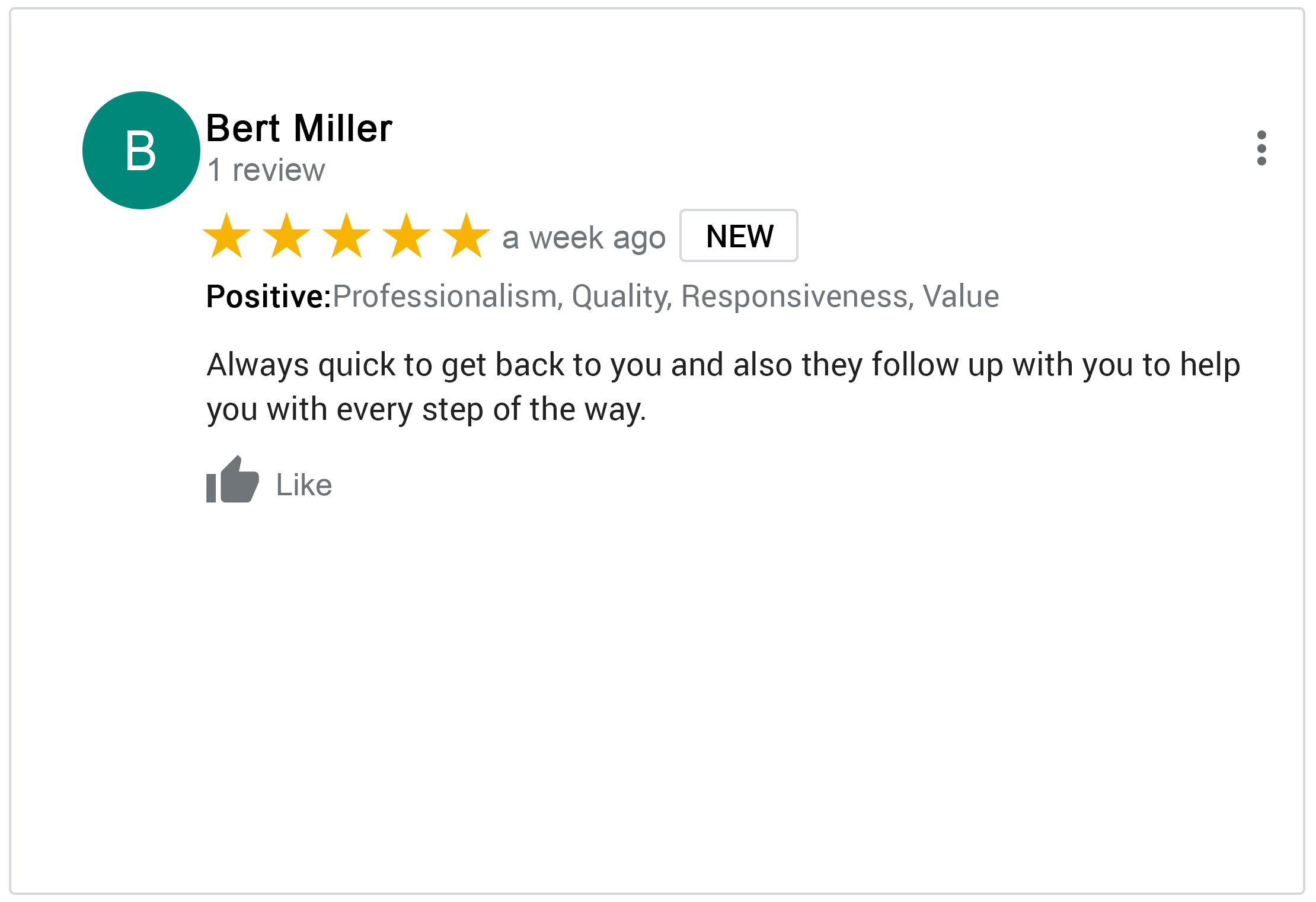

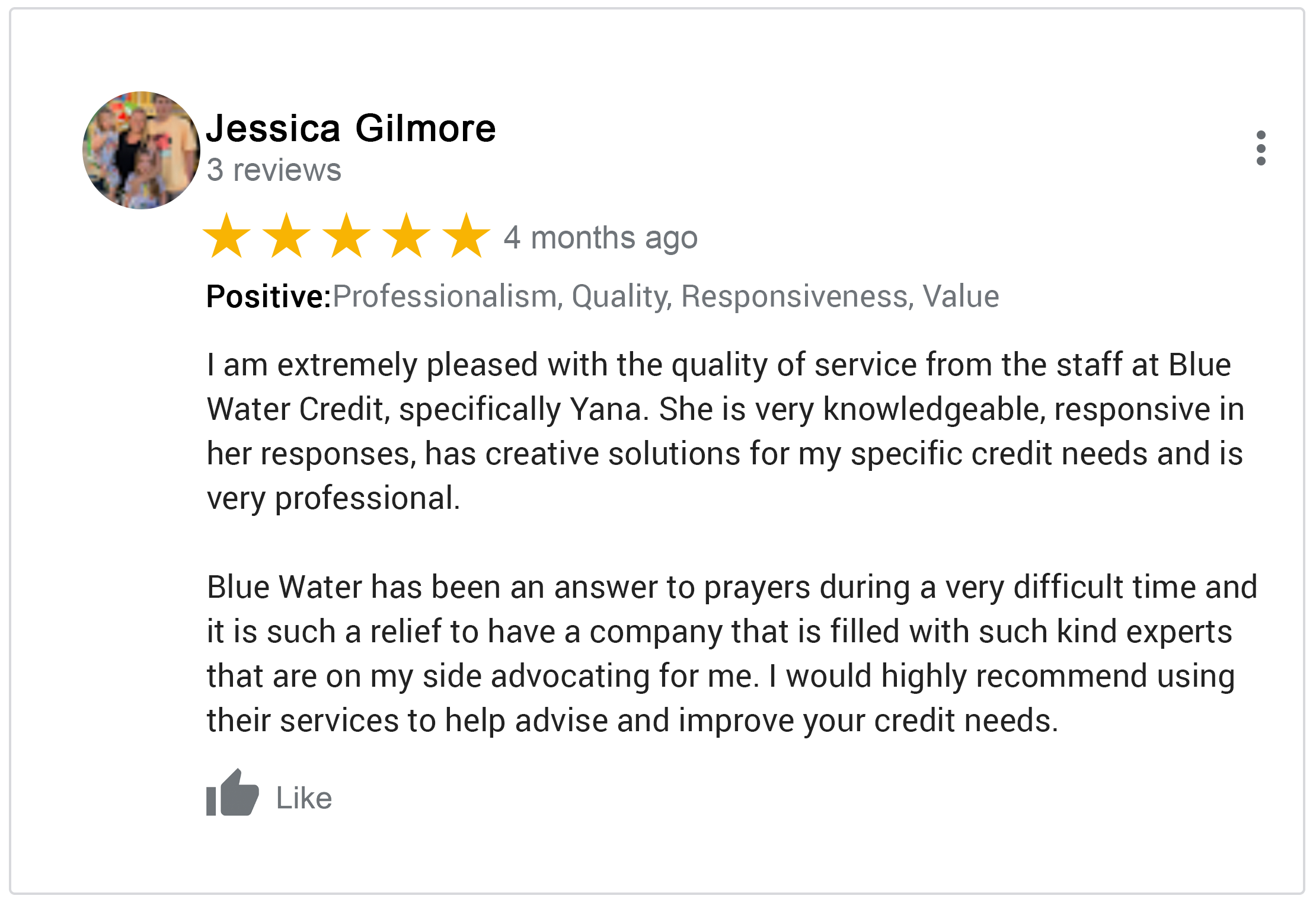

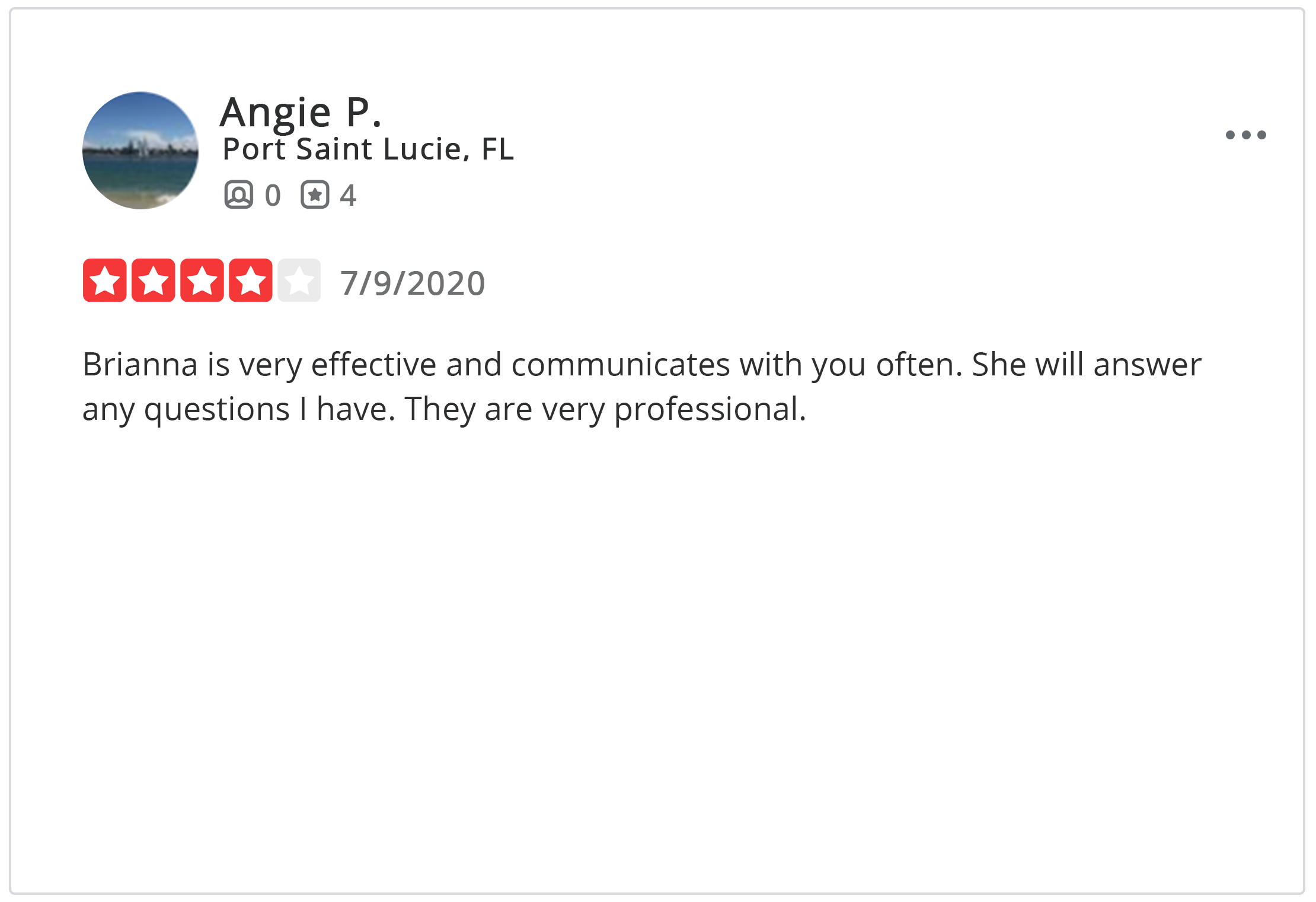

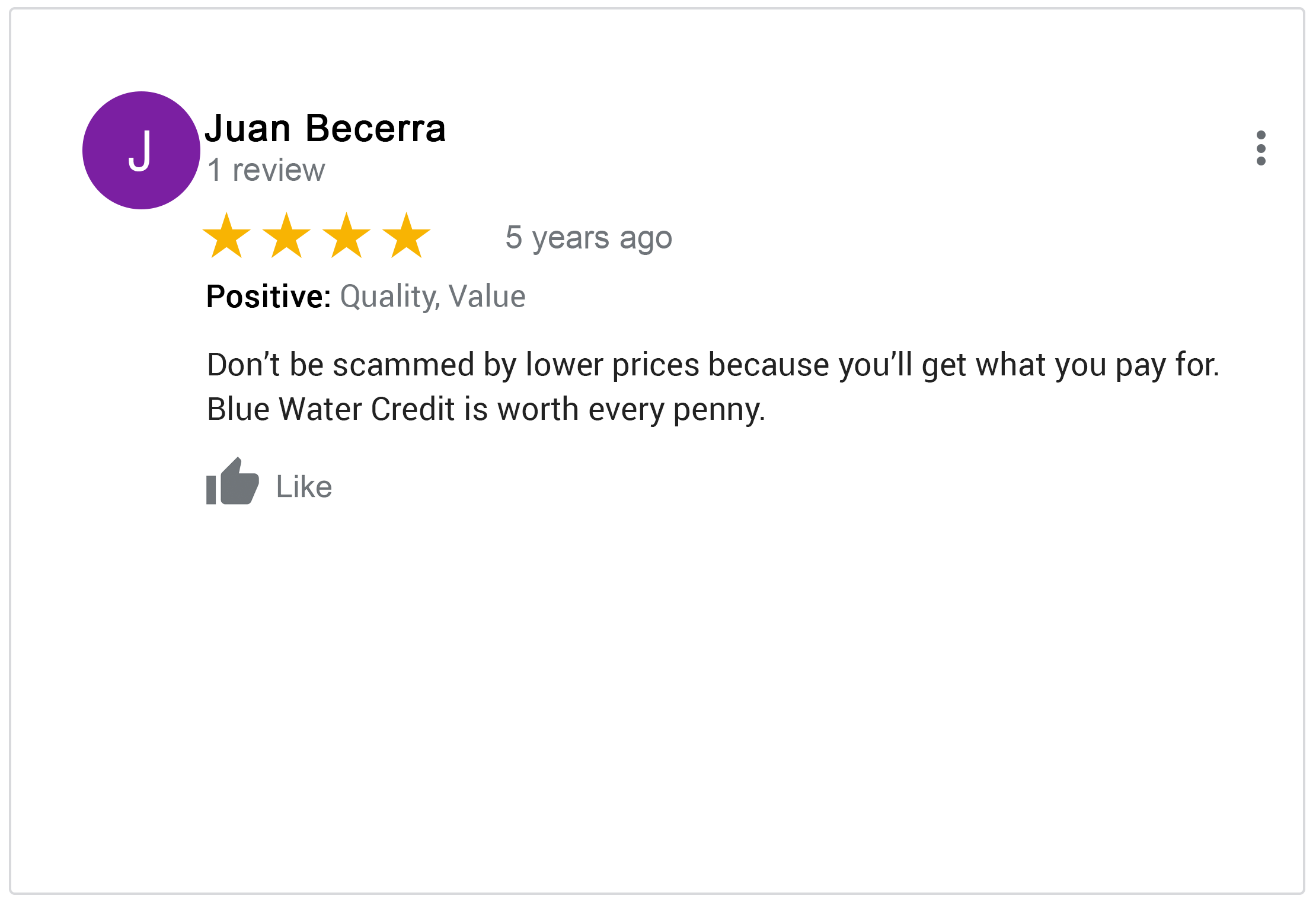

Locating the best credit repair Colorado service provider is an overwhelming and intimidating job to do. However, you don’t really have to go through such a lot of hassle to locate the ideal company. That’s because you need to focus on the basics. This is where you need to take a look at the presence of the credit repair company and the reviews that they have been able to attract in the past. These reviews clearly explain what kind of service the credit repair company is capable of delivering. If you can find a lot of gleaming positive reviews, you can stop your research because you have discovered the ideal service provider. All you have to do is to consult the credit repair Colorado agency and get the services that are offered.

In case you want to skip the process that you should follow to locate a credit repair Colorado service provider, you can take a look at Blue Water Credit. Blue Water Credit is one of the most reputed credit repair companies in the country. We offer the services to people in Colorado as well.

Blue Water Credit is extremely well versed with the United States Code that is needed to be an effective service provider with credit repair. In addition to that, Blue Water credit is compliant with federal law as well. You will be able to get connected with Blue Water Credit and receive all the assistance that you need.

When you are hiring a company such as Blue Water Credit to ensure the credit restoration process, you will be able to go through a convenient and hassle-free experience. That’s because the experts who are working for the credit repair Colorado agency will be able to provide appropriate guidance to you from the basics. All you have to do is to stick to the basics at all times.

Blue Water credit and the expert consultants working for it have a clear understanding of the rights of the consumers. Therefore, much-needed support will be delivered with ensuring your rights. You can expect to receive the best possible support that is needed at the end of the day. Everything done by Blue Water Credit to boost your credit score will adhere to the laws that are associated with it.

Therefore, you can make sure that you will not have to experience any negative consequences in the long run.

The subject matter experts who work for Blue Water Credit can provide guidance to you and you will be able to stick to it and end up getting all the positive returns that you want.

Our Promise to You.

We believe there is more to life than making a living- we want to make a difference. Blue Water Credit’s goal is to provide you with a great experience with our company, whether you just call in for advice or become a client. We aim to set clear expectations, have good communication and only take on clients we feel would benefit from our services.